Shares in Sydney fintech Prospa have plunged nearly 28% in early trade on Monday, to a record low of $2.79 after the company released a trading update that downgraded revenue expectations for the remainder of 2019, less than six months after its IPO.

The market reacted savagely to news, wiping more than $1 off the company’s share price, which sat at AU$3.86 on Friday’s close. The SME business lender listed on the ASX on June 11 at $3.78 a share, raising $109.6 million.

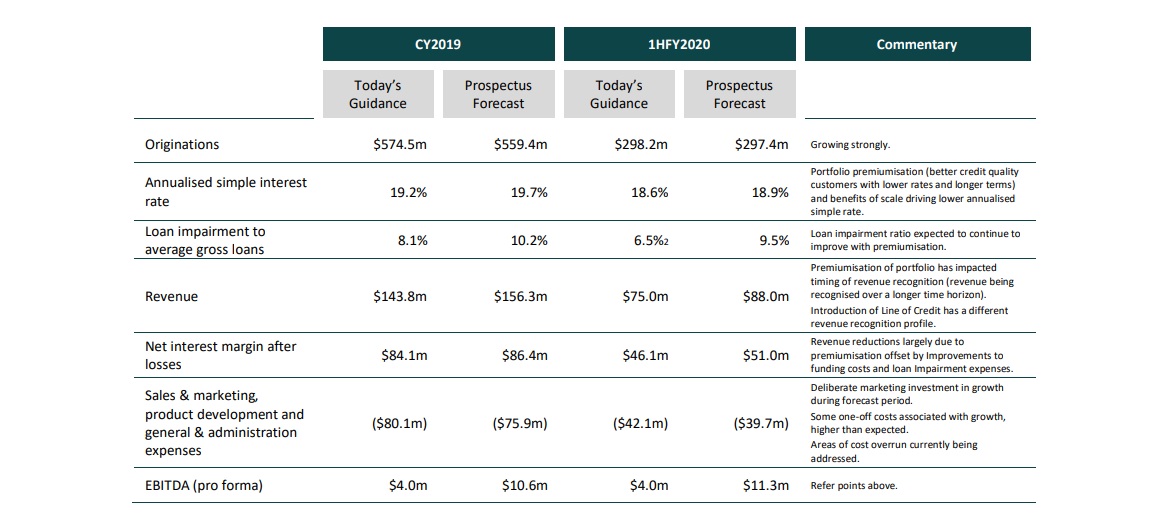

The company predicts total revenue for CY2019 will be down 8% on the prospectus prediction of AU$156.3 million to $143.8 million.

In its statement to the ASX, Prospa said the change was “largely due to the premiumisation strategy exceeding our forecast” from premium credit quality customers who pay lower interest rates over longer terms.

The company revised down its prospectus forecast on the annualised simple interest rate paid by customers in CY19 by 0.5% to 19.2%.

Delays in rolling out its new line of credit product were also blamed for the reduced revenue.

“The revenue shortfall is expected to be largely offset by reductions in loan impairment expense and funding costs, such that the CY19 net interest margin after losses is forecast to reduce by $2.3 million on Prospectus levels,” the company said, adding that it expects to see further reductions in net impairments.

Net interest margin fell by $2.3 million to a new forecast of $84.1 million in CY19.

Loan impairment as a proportion of gross loans were revised to 8.1% in Cy19, down on the 10.2% forecast.

But hardest hit by the adjustments is Prospa’s prospectus EBITDA (earnings before interest, tax, depreciation and amortisation) of $10.6 million, plunging 62% to just $4 million.

The company blamed the dramatic change on acceleration of growth investment; a number of one-off expenditures; and “some cost over-run which we currently addressing”.

Sales and marketing and other costs rose by more than $4 million on forecast

The company expects CY19 originations to be 2.7% ahead of the prospectus forecast at $574.5 million.

Prospa’s revised trading guidance provided to the ASX on Nov 18. Source: Prospa

Prospa remains upbeat about its FY2020 result, forecasting higher originations at between $626-640 million, with revenue also rising to more than $150 million.

“Originations are growing. Portfolio premiumisation means a higher quality loan book and lower rates and longer average terms for our customers. Early loss indicators continue to improve and we expect to continue to invest in new products, sales and marketing.

His colleague and joint CEO Beau Bertoli said the company growth plans remain unchanged, saying the revenue adjustments were “recognition for the evolution of our business”.

Trending

Daily startup news and insights, delivered to your inbox.