Payright co-founders Piers Redward and Myles Redward. Photo: supplied

Australian payment plan fintech Payright is launching its buy now, pay later service in New Zealand in its first offshore foray.

The buy now, pay later (BNPL) startup, typically for products prices between around $1,000 and up to $20,000, will start across the Tasman with direct sales companies Saladmaster, Amway and Nutrimetics along with photography studio clients. Other Payright Australian merchants will roll out there over the coming months.

Payright co-founder and joint CEO Myles Redward said there was “untapped opportunity” in New Zealand market, adding that sectors such as home improvement, photography, dental and health and beauty were underserviced.

Payright is targeting the services market, including plumbers, photographers, dentists and beauty therapists as part of its strategy, with millennials aged 25-34 their predominant customers (29%) ahead of the 35-44 age group (23%) and what it calls “youthful” Boomers aged 45-54 (18%). Twice as many women (68%) use Payright as men (31%).

Those figures align roughly with research released last week by Roy Morgan revealing 1.95 million Australians have used a BNPL service, in the 12 months to September, up by 41 % on the previous year, as credit card usage fell by 3% over the same period.

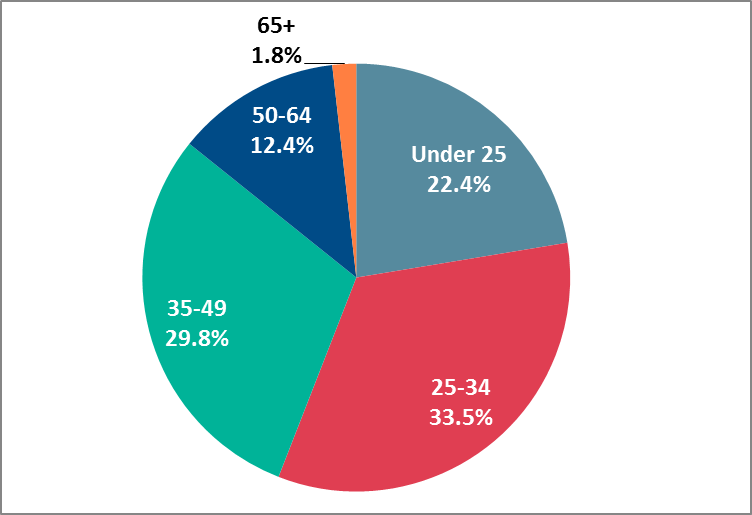

Roy Morgan found people aged 14-34 were 55.9% of BNPL users, with those aged 25-34 making up 33.5% of all users. The researchers concluded the 25-34 cohort is nearly twice as likely to use a BNPL system compared to the average across the whole nation.

Payright’s top three sales categories are photography (33%), health and beauty (26%), and home improvement (14%), with average spends of around $8,000 for home improvement, $2,000 for photography, and $1,200 for health and beauty.

Payright says that in its first three years of lending, it’s had more than 28,000 customers, acquired over 1,600 merchants and written 22,000 plans totalling approximately AU$68 million. The Payright team has grown from three to more than 60.

Payright is chasing Australian-based global market leaders Afterpay and Zip.

Roy Morgan CEO Michele Levin said Australia’s payment landscape is facing rapid change, with buy-now-pay-later providers threatening traditional deferred payment options.

“The increasing use of new payment technologies is being aided by the growing proliferation and development of smart phones and wearables with integrated technology such as Apple Pay and Google Pay,” she said.

“Traditional financial institutions may need to collaborate with fintechs and other third parties to keep up with the fast-moving digital payment environment.”

While the growth of the sector is rapid, Levin noted that overall numbers are still relatively low with only 9.4% of the population using them, up from 6.8% a year ago.

Even among the heaviest user group, those aged 25-34, only 17.4% use BNPL.

Users tend to be lower earners, with around 11.7% earning between $40,000 and 49,999, compared with 8.8% of Australians overall.

While 4.4% of the overall population earn $150,000 a year or more, the make up only 2.2% of BNPL users.

Roy Morgan found more than half of Australian consumers (52.2%) know about BNPL.

Afterpay dominates the market, with 49.5% awareness and 8.4% usage over a 12-month period, followed by Zip (ZipPay and ZipMoney), which has an awareness of 29.3% and 2.8% usage.

Trending

Daily startup news and insights, delivered to your inbox.