Hello and welcome to tech on Tuesday.

Let’s do this.

1. Prospa had a really bad day

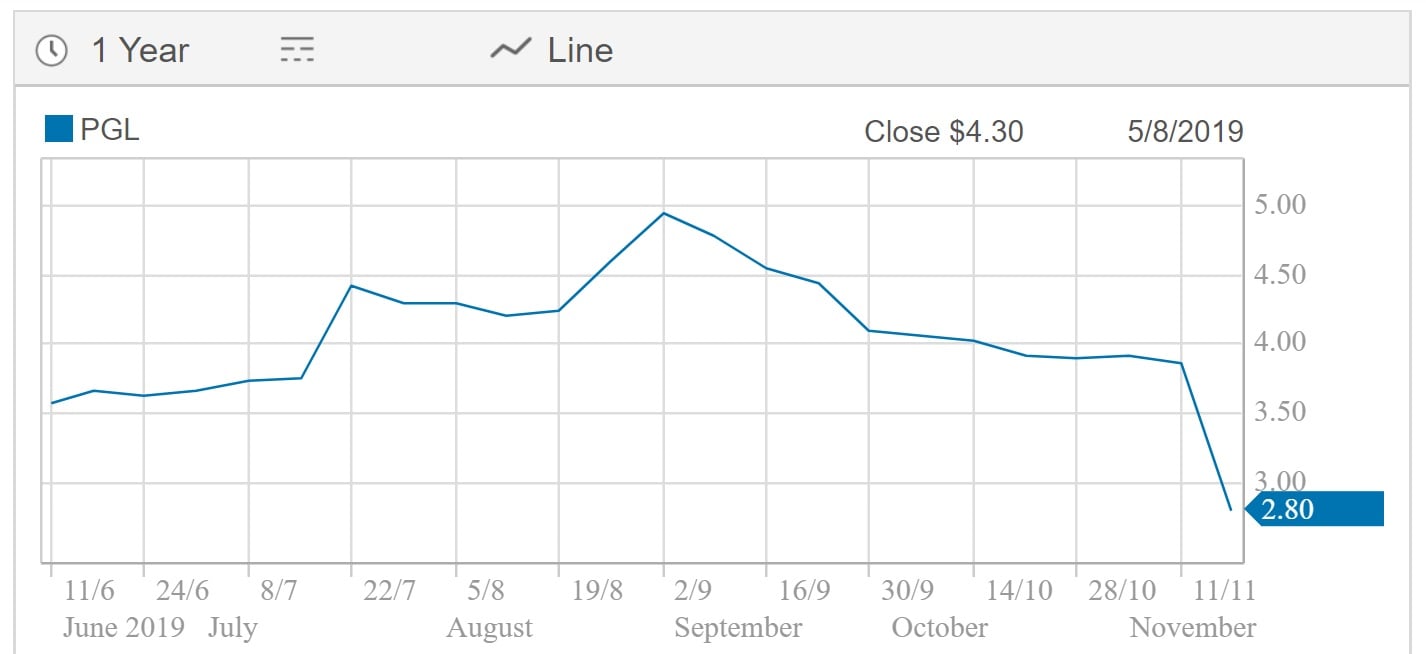

When the small business lender floated on the ASX in June at $3.78 a share, Prospa was seen as a startup success story. Yesterday the company told the ASX it was downgrading its revenue expectations for the remainder of 2019 and investors savaged the business, wiping 27.5% off the company’s share price, which flat-lined for Monday at $2.80.

Here’s Prospa’s share price since its IPO on June 11.

Prospa’s share price since floating in June. Source: CommSec

The company predicts total revenue for CY2019 will be down 8%, or more than $12 million on the prospectus prediction of AU$156.3m.

The reason? It’s actually getting better quality borrowers, which means they charge them a lower interest rate. Prospa argues that’s better in the longer term, with less defaults reducing losses alongside lower funding costs, but the company also revised its prospectus EBITDA of $10.6 million down 62% to $4 million, attributing the change to acceleration of growth investment; a number of one-off expenditures; and “some cost over-run which we currently addressing”.

Prospa co-founder Greg Moshal said that despite the short-term impacts “the business was largely on track”, upping the level of loans it expects to originate, but with markets increasing wary about tech company promises v reality, it’s not a good look for the sector when an ASX-listed startup has to revise its revenue predictions so soon after floating.

More on Monday’s meltdown and the company’s explanation here.

Prospa’s share price is up 2% in early trade today.

2. Unions appeals UberEats driver sacking

BREAKING: TWU case against @Uber opens in Sydney. We’re fighting this tech behemoth whose calling card is unfair sackings, low rates and exploitation #GigWorkersRising pic.twitter.com/c6YydZ2efs

— TWU Australia (@TWUAus) November 17, 2019

The Transport Workers Union (TWU) headed to the Fair Work Commission (FWC) on Monday to appeal against UberEats dropping a delivery driver who was 10 minutes late delivering food.

Adelaide UberEats driver Amita Gupta was locked out of the app by the tech giant in January following the late delivery. She launched an unfair dismissal case with the FWC, which ruled that she wasn’t an employee, and thus not covered by the law.

The TWU is appealing the decision, comparing Uber’s control over how its contractors operate to slavery, claiming Gupta worked for Uber Eats for up to 96 hours a week.

The case could be a watershed for gig economy workers if the FWC rules Gupta was an employee. More here.

3. It’s D Day

As in Disney+, the latest video-on-demand streaming service to land in Australia. The bad news for Stan subscribers is that means all the Disney content – think the Pixar, Marvel and Star Wars movies – is gone, just a year after the Australian-only streaming service brought the US giant on board. Signing up for Disney+ will cost you $8.99 monthly or $89.99 for a year.

But it hasn’t been a smooth start for the service, which launched in the US on Nov 12. User have complained about tech and streaming problems, and worse, ZDnet reports thousands of Disney+ accounts have been hacked, with the customer details and accounts being offered for sale or for free on the dark web.

4. US regulators are taking a closer look at WeWork

The US Securities and Exchange Commission’s enforcement division is taking a closer look at WeWork’s disastrous IPO attempt for potential breaches of disclosure rules and misleading investors, Bloomberg reports.

5. $500k for dog food

Pet food subscription service Lyka has raised AU$500,000 in seed funding. Calling itself a “human-grade” [insert pensioner joke here] pet food company, founded in 2018 by former Bain & Co. consultant Anna Podolsky and vet Dr Matthew Muir, the venture pitches a healthier, fresh wholefoods diet for dogs. The raise took six weeks, backed by undisclosed individual investors close to the duo. The money will go towards accelerating growth, expanding operations and expanding the core team.

BONUS ITEM: The Big Battery – soon with more Bigger.

Tesla big battery in South Australia is about to get bigger https://t.co/dPBAbXr8gD

— Jay Weatherill (@JayWeatherill) November 18, 2019

Trending

Daily startup news and insights, delivered to your inbox.